From being an unfamiliar term among investors, ESG has been visible everywhere since Covid. These three little letters have been plastered everywhere from fund factsheets to news and even personal blogs. Learn more about ESG investing, rediscover an age old concept with PIAS here.

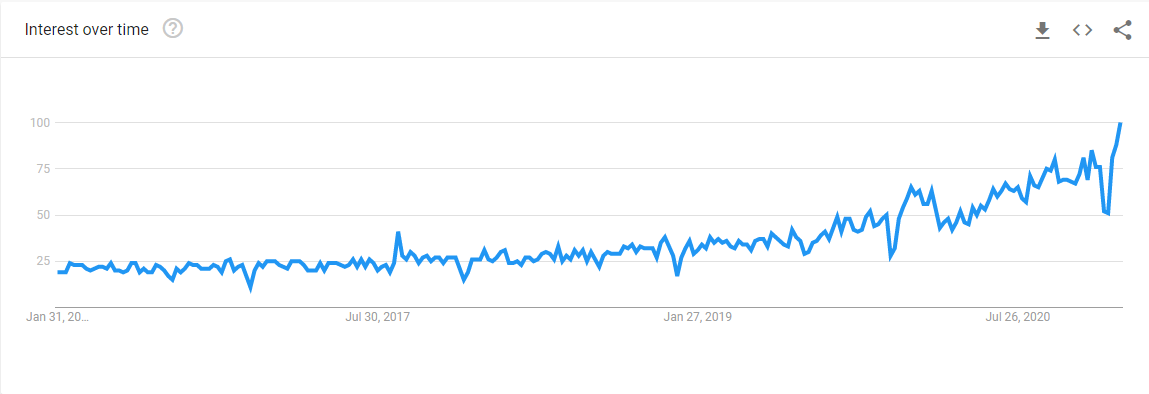

There is also recent trends of more people looking up “ESG” online according to Google Trends.

However, unbeknownst to many, the concept of socially responsible investing (SRI) started as early as in the 1960s to 1970s; when investors began excluding stocks from the tobacco industry or involvement in the South African apartheid regime. The term “ESG” was only coined in 2005 after a landmark study on SRI. It grew to something bigger than ethical or moral concerns to include the negative screening of alcohol, tobacco and firearm industry players.

Since then, ESG has evolved to something of significance to both investors and investment managers alike. ESG encompasses three major components; Environmental, Social, Corporate Governance with the initial alphabet making up the acronym.

Environmental – This component delves into the realm of how companies impact the Earth in both positive and negative ways. Investors take note on how companies deal with the environmental issues at hand (e.g. climate change, greenhouse gas pollution etc.) and whether they deserve investor’s dollars. Companies which ignore environmental issues tend to be excluded from ESG-focused portfolios.

Social – This component looks into the social aspect of the company like the company culture, or any issues impacting employees, customers, consumers and suppliers. As well-taken care off employees are known to be more productive and loyal, thereby reducing turnover and unnecessary expenses for hiring, potentially providing positive corporate earnings.

Governance – This component looks at the corporate governance of the company. It relates closely to the board of directors compensation, company oversight and management as well as shareholder accountability.

Why bother about ESG now?

The 2020 Coronavirus pandemic highlighted the “Social” component of ESG as more people worked from home. Concerns over consumerism and supply chains were key topics as businesses were asked to shut down or move online, borders closed and the realization that a globalized world has come to a standstill. Thus, accelerating the ESG movement across various industries. Coupled with the fact that climate conditions played a role in the spread of the virus, this added another level of awareness towards the urgency to fight climate change.

With the Democrats dominating the U.S. Congress for at least the next four years, it is almost a certainty that the Biden administration will propose policies with a strong sustainability agenda. Biden’s climate-focused approach will starkly contrast with his predecessor’s, seeking to re-join the Paris Climate Agreement and targeting to be net-zero emissions by year 2050. U.S. will also be hosting a climate summit in April, taking leadership and echoing other world leaders’ calls and focus to combat climate change. US still has a long way to catch up with Europe, who has a lead in the booming $40 trillion sustainable finance industry and fund inflows to Europe were 5 times of flows to US. Pricewaterhouse Coopers estimates that Europe accounts for almost 70% of global ESG mutual fund assets.

Previously, socially responsible investing had a reputation of requiring investors to make a trade-off in performance given the limited investible universe. However, we are now experiencing more investment managers implementing ESG into their investment framework. What used to be thought of as a fad is becoming mainstream. This will likely cascade down to companies to “clean up their act” before investment managers review their companies for investing bringing forth more investment options for clients. We believe that as both companies and investors become aware of ESG and its benefits, sustainable investing will be a trend that will stick around for many years to come.

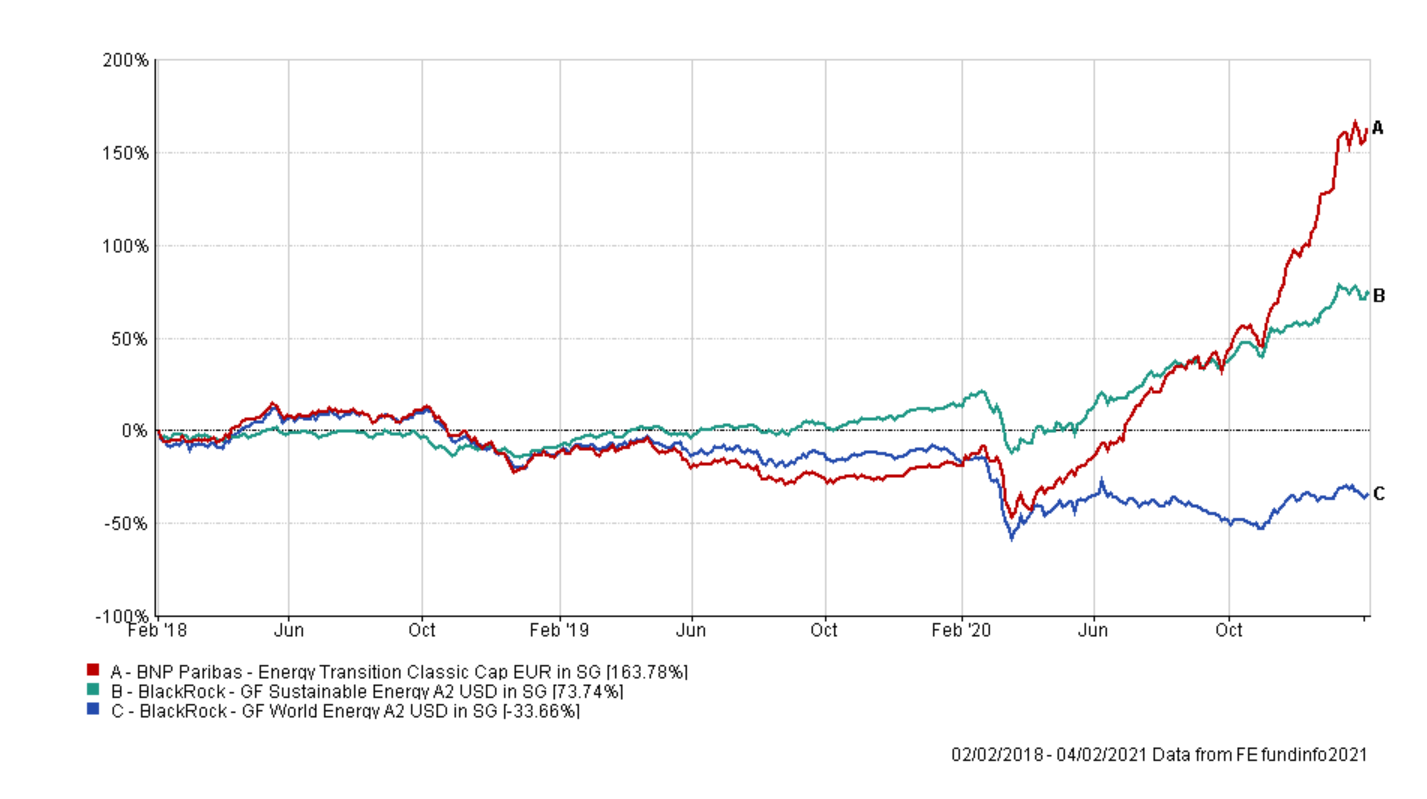

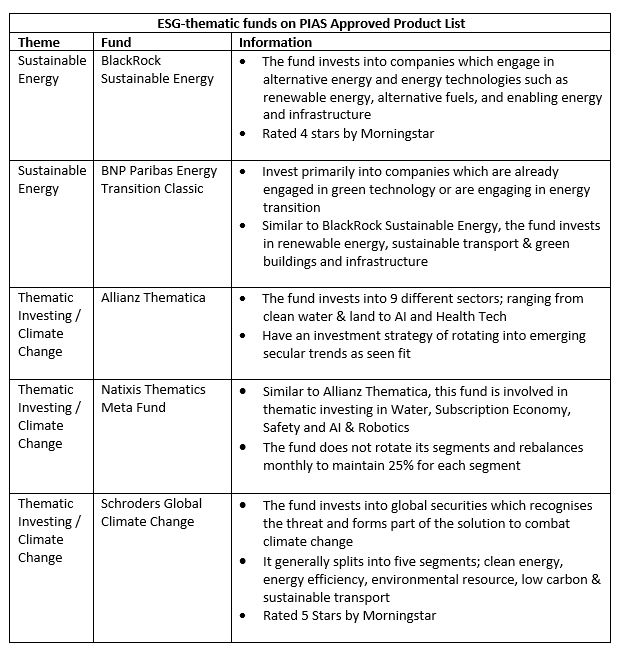

Sustainable Energy

Since the onset of the pandemic, both fund performances greatly improved with the urgent call to action on climate change and ESG becoming more mainstream. Based on the chart below, we can see how the sustainable energy funds greatly outperformed conventional energy fund by a huge margin.

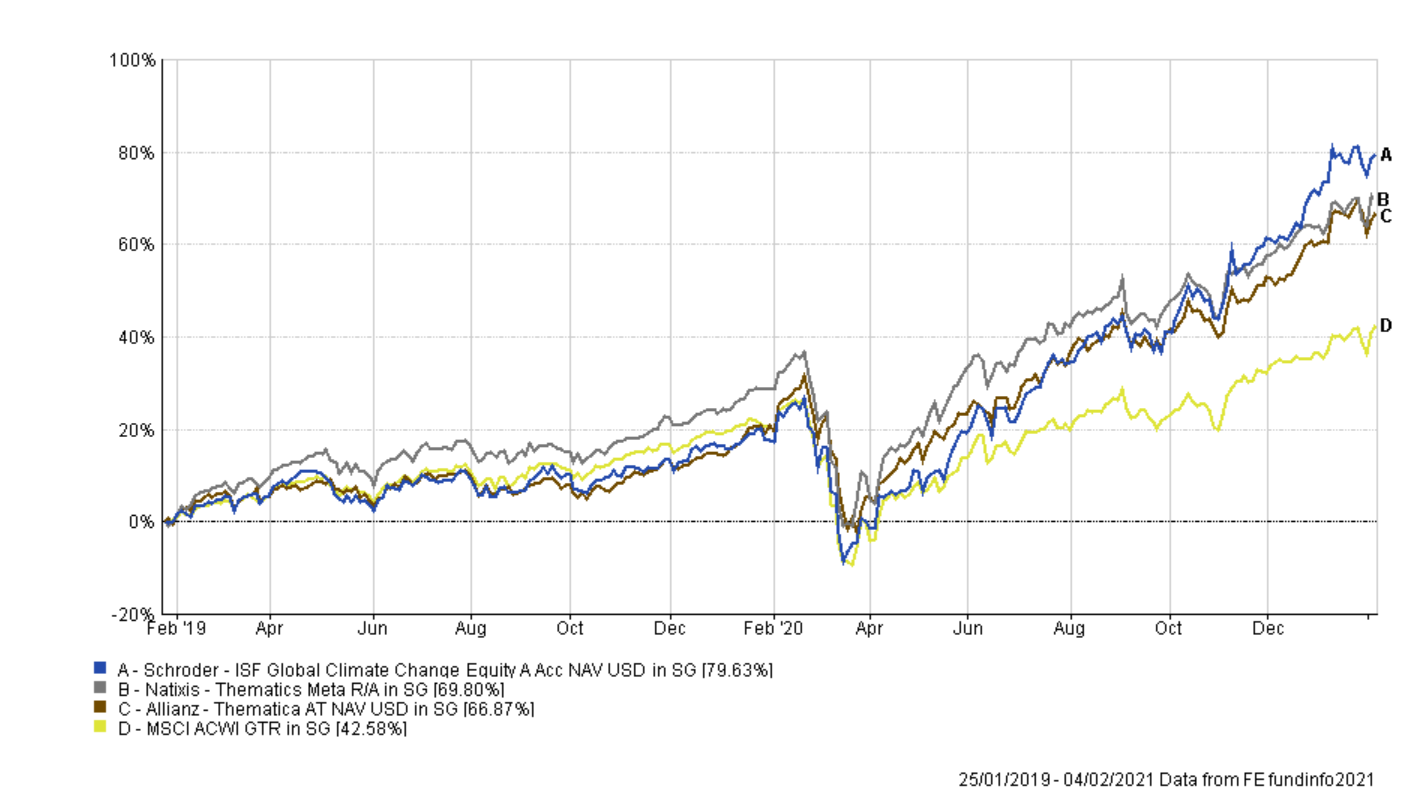

Thematic Investing / Climate Change

Thematic investing funds invests in the latest secular trends and climate change industries. The funds are benchmarked against the Global Equity Index and has shown outperformances against the benchmark noticeably after the March 2020 sell-off.

For general information only. This is not an offer or a recommendation, and does not have any regard to the investment objectives, financial situation or needs of any person. You may wish to seek advice from your financial adviser before making a commitment to purchase a product and should consider carefully whether the product is suitable for you. Full details including the terms and conditions can be found in the Factsheets and Product Highlight Sheets of the respective funds. This article has not been reviewed by the Monetary Authority of Singapore.

Important information

This article should not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. The information provided herein is intended for general circulation only and does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You may wish to seek advice from a financial adviser before making a commitment to purchase any investment products. In the event you choose not to seek advice from a financial adviser, you should consider carefully whether the product(s) are suitable for you.