Enjoy tax savings and invest your SRS while planning for your retirement with PIAS Singapore.

What’s in it for you to contribute to Supplementary Retirement Scheme (SRS)?

· Achieve tax savings with SRS. Every dollar contributed to your SRS reduces your taxable income by a dollar up to a cap of $15,300 for Singapore citizens and PRs and $35,700 for foreigners. Here's an illustration of how much you could save in taxes:

| Employment income | S$100,000 | |

| Less: Personal reliefs | S$30,000 | |

| Without SRS | With SRS | |

| SRS contribution | NA | S$15,300 |

| Total relief | S$30,000 | S$45,300 |

| Chargeable income | S$70,000 | S$54,700 |

| Total tax | S$2,650 | S$1,579 |

| Potential tax savings | S$ 1,071 (You save 40.42% in taxes this year!) | |

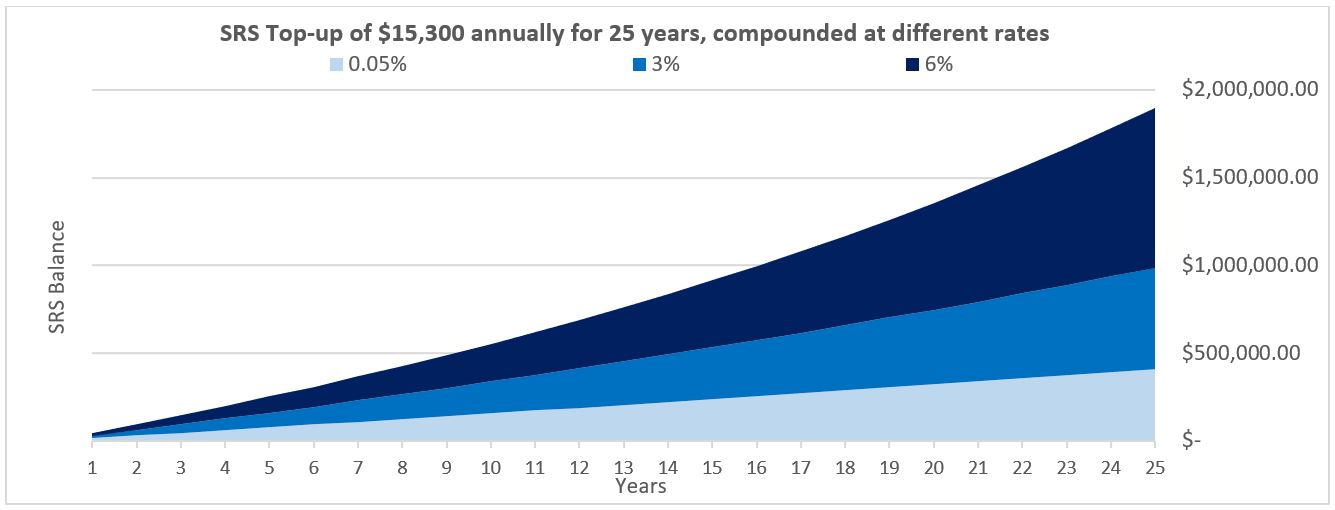

· Invest for potential higher returns. Use your SRS funds to buy into various financial products such as unit trusts/single premium insurance for potential retirement gains. You can earn potentially higher interest, as your balance in the SRS account earns only 0.05% interest p.a. However, as with all investments, there is always the possibility of losses. Hence, it is important that you start investing based on your risk profile.

· Use your SRS in your retirement years. To maximise the benefit of SRS, you can make withdrawals from your account upon reaching the statutory retirement age (currently 62 as at Year 2021), prevailing at the time of your first contribution. Only 50% of your withdrawals are subject to tax.

Investment Solutions with PIAS

PIAS Model Portfolios (SRS)

· Catered for investors from Conservative to Aggressive risk profiles, you could enhance the potential of your SRS returns with a Model Portfolio suitable to your risk appetite and needs

· Each Model Portfolio is diversified and constructed using 5 to 6 Unit Trusts, shortlisted by an extensive research process with ongoing reviews to maximize risk-adjusted returns over a long-term

· Exclusive to PIAS clients, the portfolio positioning is aligned to PIAS Investment Outlook, with regular monitoring, updates and management by the Investment Strategy team, in line with the changing investment climates

Insurance Solutions with PIAS

· Your SRS funds can be used to purchase selected single premium insurance plans. Over at PIAS, we have a suite of products from our partner providers that you can explore further with our advisers for your needs.

· These plans allow you to grow your SRS funds while providing insurance coverage against death and total permanent disability (TPD) during the policy term. What’s more, application is typically easy with no health-check needed.

· Insurance products bought with SRS are also protected by the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC).

Get started with SRS

SRS is a useful way to achieve tax savings while supplementing your retirement funds at the same time. Participation in SRS is voluntary. If you wish to enjoy any tax savings for 2021, you will need to contribute your SRS contribution by 31 December 2021.

This article was first published in November 2020 and has been updated in July 2021.

Full details of the terms and conditions can be found in the relevant fact sheets and policy contracts. This advertisement has not been reviewed by the Monetary Authority of Singapore.

This publication is for general circulation only. It does not form part of any offer or recommendation, or have any regard to the investment objectives, financial situation or needs of any specific person. You may wish to seek advice from a financial adviser representative before making a commitment to purchase [this/these] product[s]. In the event that you choose not to seek advice from a financial adviser representative, you should consider carefully whether the product [is/are] suitable for you.

Important information

This article should not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. The information provided herein is intended for general circulation only and does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You may wish to seek advice from a financial adviser before making a commitment to purchase any investment products. In the event you choose not to seek advice from a financial adviser, you should consider carefully whether the product(s) are suitable for you.