Learn more about the key changes for MediShield Life which will be implemented in March 2021.

The MediShield Life Council appointed by the Government undertook the first major review of the MediShield Life scheme since its launch in 2015 to ensure that the scheme remains sustainable and relevant to the needs of Singaporeans. Subsequently, on 21 December 2020, the Government announced that it had accepted all the recommendations from the Council.

Here are the key changes for MediShield Life which will be implemented in March 2021.

#1 Policy year claim limit will be raised from $100,000 to $150,000

This will be a welcomed change as about 100 people hit the limit in 2019 and got no further coverage for their large hospital bills. With the increase in limit, this would give Singaporeans better protection against exceptionally large bills from long or multiple hospitalizations throughout the year.

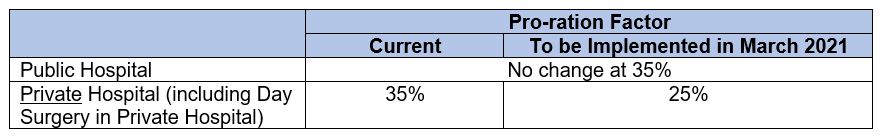

#2 Private hospital claims from MediShield Life will be prorated by 25% down from 35%

This is to ensure more comparable MediShield Life payouts between private hospital and subsidised patients. However, this is a change that will affect policyholders who seek private hospital care.

Currently, if you incur a private hospital bill say for example of $50,000, MediShield Life would recognize the bill at $17,500 (35% of $50,000) and any claim being made on MediShield Life will be based on this pro-rated amount. However, over the past four years, the average bill size for inpatient and day surgeries in private hospital has increased about 20% faster than in public hospitals. So, the pro-ration factor will be lowered to 25% from 35% come March 2021. Hence, the MediShield Life claim will then be based on a lower amount of $12,500 (25% of $50,000).

If you have an Integrated Shield plan providing coverage for private hospital bills, your insurer will have to potentially foot a larger share of each private hospital bill which it possibly has to weigh against other benefits for which MediShield Life’s higher coverage will reduce the insurer’s share of the bill, and also the insurer’s own claims experience, to decide whether to pass on any additional cost or savings to policyholders in the form of premium adjustments.

There is no impact on policyholders who opt for unsubsidized A or B1 class treatment in public hospitals as their pro-ration factors will remain unchanged.

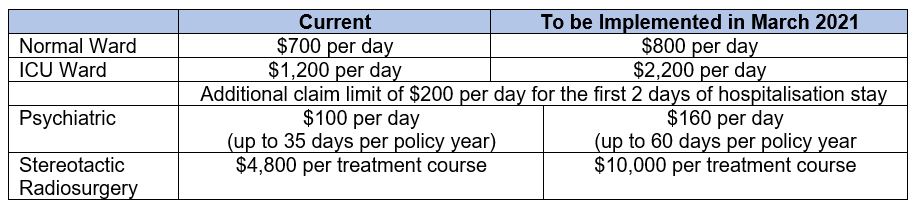

#3 Higher daily ward claim limits for inpatient treatments and additional claim limits for the first two hospitalisation stays

To provide better coverage for short stays, particularly as advances in healthcare facilitates some patients to be discharged and return home earlier, there will be an additional $200 a day claim for daily ward charges for the first two days of hospitalisation, when most tests and investigations are done.

Claims limits for inpatient treatments for Psychiatric and Stereotactic Radiosurgery are also enhanced.

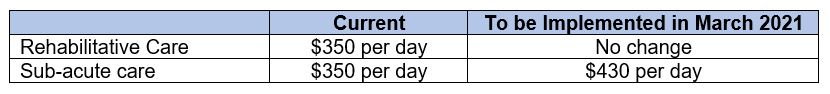

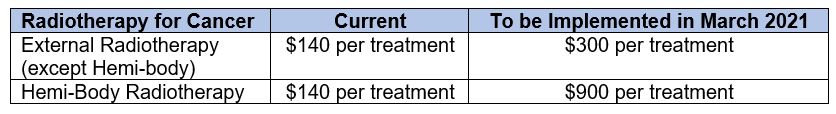

#4 Higher coverage for sub-acute care at community hospitals and for outpatient radiotherapy

Community hospitals offer two main types of inpatient care – rehabilitative care, which is therapy to improve one’s post-illness disability and functional impairment, and sub-acute care (such as for someone recovering from a heart attack), which is for complicated medical conditions that require additional medical and nursing care.

Sub-acute care is more intensive than rehabilitative care, and hence more costly. The daily claim limit at community hospitals is currently adequate to cover rehabilitative care, but not sub-acute care, which costs about 20% more. The claim limit is hence to be raised to $430 a day for sub-acute care.

In addition, treatment-specific claim limits for outpatient radiotherapy will also be introduced to improve coverage for the more costly types of treatment.

#5: Include coverage of treatment for attempted suicide, intentional self-injury, substance abuse and alcoholism

These are currently standard exclusions for such treatments. In recognition that treatment plays an increasingly important part in the support and recovery of these patients, these exclusions from MediShield Life will be removed. However, treatments arising from the use of illicit controlled substances will remain excluded.

Increase in MediShield Life premiums to ensure sustainability

Since its launch in 2015, MediShield Life has been providing more payouts and greater protection for more Singaporeans. Against the background of an evolving healthcare landscape and cost inflation, annual payouts have increased by close to 40% and the number of Singaporeans who have made claims has increased by about 30% between 2016 and 2019. Hence, for the scheme to continue to be able to provide these payouts to Singaporeans, premiums will have to increase.

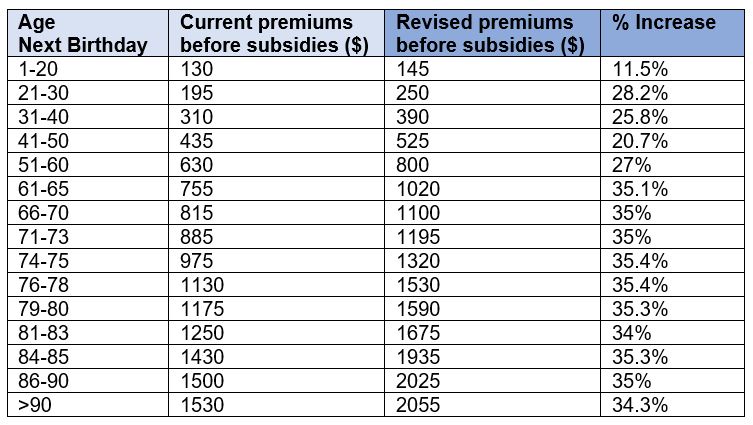

Coupled with these changes as accepted by the Government, premiums before subsidies are expected to go up in 2021 by as much as 35% for certain age bands typically those age 61 and above (age next birthday).

Premium subsidies from the Government

The Government will soften the impact of the premium increase with a special Covid-19 subsidy for the first two years. In the first year, all Singapore Citizens will get a 70% subsidy on the net premium increase. This goes down to 30% in the second year. This will cost the Government $360 million.

This is on top of the existing subsidies of up to 50% given to middle- and lower-income groups, and up to 60% for all Pioneers. All Merdeka Generation seniors receive additional subsidies of up to 10% on top of the existing subsidies.

Net increase for all Singapore Citizens will be kept to no more than about 10% in the first year, after factoring in existing and additional subsidies, including the COVID-19 subsidy.

To further cushion the impact of the premium increases, MediShield Life premium payment will be deferred until end December 2021 for those who have insufficient MediSave balances and are unable to pay their premiums due to the economic impact from COVID-19.

The MediShield Life scheme will be reviewed and updated every three years in order to keep up better with the pace of the medical practices, healthcare cost inflation and actual claims experiences.

How will these changes affect my existing Integrated Shield Plan (IP) coverage and premiums?

Your Integrated Shield plans from the private insurers are integrated with MediShield Life.

With the widening of benefits for MediShield Life, the coverage for your Integrated Shield plans will be subject to review by the insurers as well.

Also, according to a statement released from the Life Insurance Association (LIA) of Singapore in September 2020, some of these changes to be implemented, may also lead to further escalation of claims costs for IPs and, consequently, IP premiums.

According to the same release by the LIA, while claims control measures have been undertaken, most insurers continue to make a net loss since the launch of MediShield Life in November 2015, hence it is possible that Integrated Shield plans will raise their premiums in 2021 too.

With the widening in benefits for MediShield Life in March 2021, do I still need to upgrade to an Integrated Shield Plan?

MediShield Life coverage is sized for treatment in public hospitals that are subsidised by the Government. Those who choose to stay in private hospitals or in A or B1 ward types at public hospitals are also covered by MediShield Life. However, as MediShield Life payouts are pegged at B2 or C ward types, the MediShield Life payout will make up a small proportion of the bill only. The patient may therefore need to pay more of their bill using MediSave and/or cash.

If you want to have additional insurance protection on top of what MediShield Life provides, such as coverage for your stay in private hospitals or A or B1 wards in public hospitals, and are prepared to pay higher premiums, you should consider upgrading to an Integrated Shield Plan. However, do consider the long-term affordability of Integrated Shield Plan premiums, especially since premiums increase with age. Speak to a financial adviser to find out more.

References:

6. https://www.cpf.gov.sg/Members/Schemes/schemes/healthcare/medishield-life

Important information

This article should not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. The information provided herein is intended for general circulation only and does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You may wish to seek advice from a financial adviser before making a commitment to purchase any investment products. In the event you choose not to seek advice from a financial adviser, you should consider carefully whether the product(s) are suitable for you.